The Washington, D.C. metro real estate market continues to shift in 2025, influenced by economic trends, political changes, and evolving buyer behaviors. Whether you’re a homebuyer, investor, or seller, understanding the latest trends can help you make informed decisions.

This guide provides a detailed overview of home prices, sales trends, rental market conditions, and future projections for the Washington, D.C. metropolitan area in February 2025.

Current Market Overview

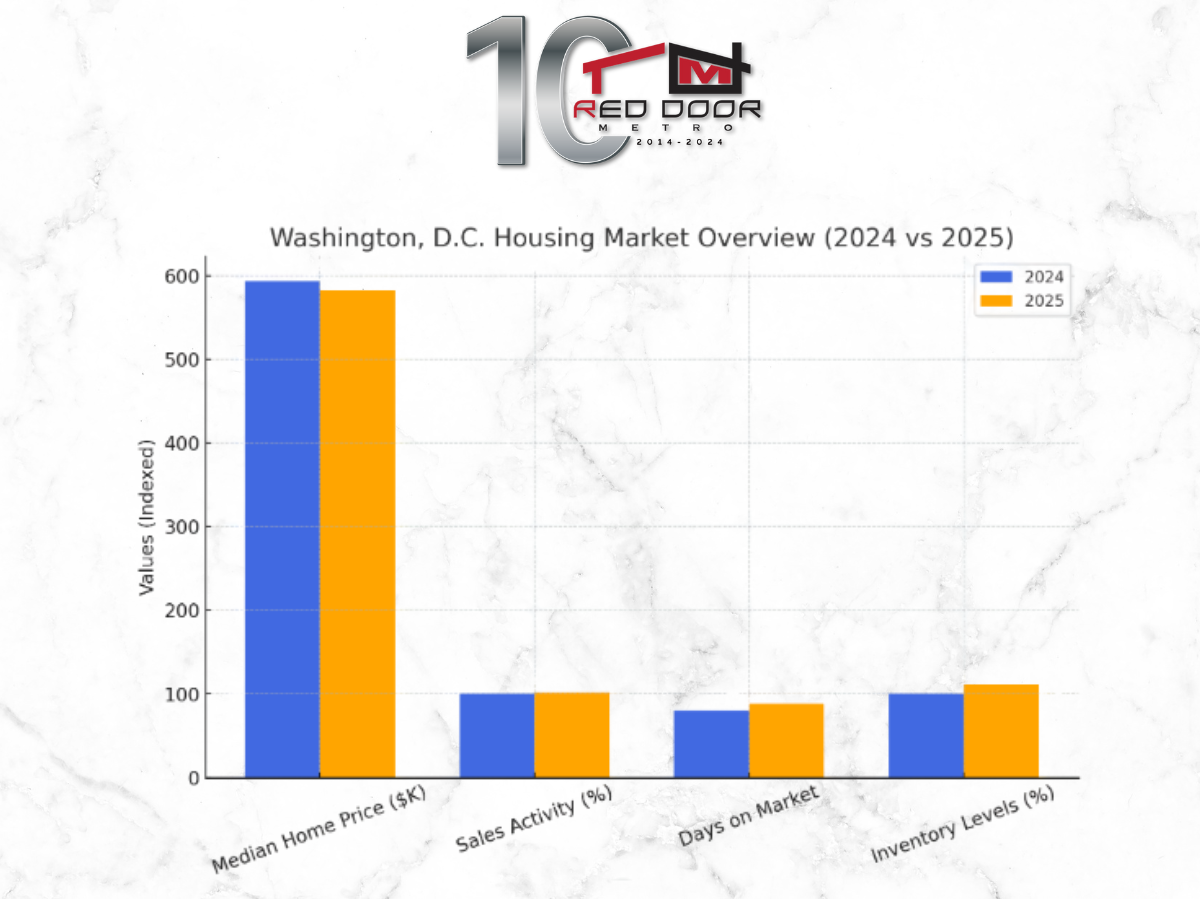

Home Prices

- The median home price in Washington, D.C. is approximately $594,000, reflecting a 2% decrease from last year.

- The decline is partly due to higher mortgage rates, which have cooled demand in some areas.

- Luxury properties in sought-after neighborhoods, such as Georgetown and Kalorama, are still holding strong, with some record-breaking sales.

Sales Activity

- Home sales have increased slightly compared to last year, with more buyers re-entering the market as mortgage rates stabilize.

- Many sellers are adjusting prices to attract buyers, leading to competitive negotiations in mid-range and luxury markets.

Days on Market

- Homes in the D.C. metro area are staying on the market for an average of 88 days, slightly longer than the 80-day average last year.

- Buyers are being more selective, leading to longer selling times, especially in suburban areas.

Inventory Levels

- The number of homes available for sale has increased by 12% from December 2024, giving buyers more options.

- However, inventory in high-demand neighborhoods remains low, keeping prices stable in those areas.

Key Factors Influencing the Market

1. Political and Economic Climate

- The recent presidential inauguration has brought new buyers to D.C., including government officials and corporate executives.

- Demand for luxury homes has increased, especially in high-profile neighborhoods.

2. Federal Workforce Adjustments

- Potential government downsizing could impact real estate, particularly in commercial office spaces.

- Residential demand may shift if job cuts lead to a migration out of the city.

3. Mortgage Rates and Affordability

- Mortgage rates are expected to gradually decrease in 2025, which could encourage more buyers to enter the market.

- First-time buyers may find better financing options in the coming months.

Neighborhood Spotlights

Kalorama

- One of D.C.’s most exclusive neighborhoods, home to diplomats and high-ranking officials.

- Recent high-value sales have kept this area competitive.

Georgetown

- Remains one of the most desirable areas, with historic charm and strong rental demand.

- Prices remain stable due to limited housing inventory.

Massachusetts Heights

- Attracts government officials and corporate executives.

- Home prices have remained resilient, even with broader market fluctuations.

Washington DC Rental Market Trends

Average Rent Prices

- The average rent in Washington, D.C. is $2,500, well above the national average.

- Luxury rentals are seeing higher demand, especially in areas with proximity to government offices.

Rental Demand

- Many professionals relocating to D.C. are opting for rentals before committing to buying a home.

- Multifamily developments are increasing, offering more choices for renters.

Future Projections for the D.C. Real Estate Market

1. Stabilizing Home Prices

- While prices have dipped slightly, experts predict moderate growth as mortgage rates decline.

- Luxury and high-demand neighborhoods will likely remain strong.

2. Increase in Home Listings

- As market conditions improve, more homeowners are expected to list properties in the coming months.

- Buyers will have more options, reducing bidding wars in some areas.

3. Office Space Challenges

- Federal workforce reductions may lead to excess office space, potentially affecting commercial real estate values.

- Some older office buildings could be converted into residential units to meet housing demand.

Final Thoughts

The Washington, D.C. metro real estate market in February 2025 is showing signs of stabilization, with increased inventory and cautious buyer activity. While some areas are seeing price adjustments, others—especially luxury and high-demand neighborhoods—remain competitive.

For buyers, this could be a good time to enter the market, especially with mortgage rates expected to decrease. Sellers should price homes strategically to attract buyers. Investors may find opportunities in rental properties and commercial real estate conversions.

Keeping a close eye on market trends and interest rates will be key for navigating the Washington, D.C. real estate landscape in 2025.

FAQs

1. What is the current state of the Washington, D.C. real estate market in February 2025?

The market is experiencing a moderate correction, with home prices stabilizing after a slight decline over the past year. More inventory is available, and mortgage rates are expected to decrease, encouraging more buyers to re-enter the market.

2. Are home prices increasing or decreasing in Washington, D.C.?

As of February 2025, home prices have declined by about 2% year-over-year. However, certain high-demand neighborhoods like Georgetown and Kalorama have retained their value due to limited inventory.

3. Is it a buyer’s or seller’s market in Washington, D.C.?

Currently, it’s shifting toward a balanced market. While buyers have more inventory to choose from, sellers in desirable areas still have the upper hand due to strong demand. Pricing homes competitively is key for sellers.

4. What are the best neighborhoods to buy property in Washington, D.C.?

- Kalorama (Luxury market, diplomatic buyers)

- Georgetown (Historic homes, strong rental demand)

- Massachusetts Heights (High-end homes, political figures)

- Shaw & Logan Circle (Trendy, young professionals)

5. How are mortgage rates affecting the market?

Mortgage rates have been fluctuating, but they are expected to gradually decrease in 2025, which will likely boost buyer activity and increase competition for homes.

6. Are first-time homebuyers struggling in D.C.?

Yes, due to high home prices and limited affordable options. However, lower mortgage rates and new government incentives could make it easier for first-time buyers to enter the market this year.

7. Is renting or buying a home a better option in 2025?

It depends on your long-term plans. Buying can be beneficial if you plan to stay for more than 5 years, especially with potential home value appreciation. However, with rising rent prices, renting might be more flexible for short-term residents.

8. How competitive is the D.C. housing market right now?

It’s less competitive than last year, with homes staying on the market for 88 days on average. However, well-priced homes in prime locations still receive multiple offers.

9. What’s the average cost of a home in Washington, D.C. in 2025?

The median home price is around $594,000. Luxury properties and townhouses in desirable areas can go for $1 million+, while condos in the outskirts can be found for $400,000–$600,000.

10. How much do I need for a down payment in D.C.?

Most buyers put down 10% to 20%, but FHA loans allow as little as 3.5% down for qualified buyers. However, with high home prices, a larger down payment can help lower monthly costs.

11. What are the best areas for real estate investment in Washington, D.C.?

- Navy Yard & Southwest Waterfront (New developments, rental potential)

- Shaw & Logan Circle (Trendy neighborhoods, high appreciation)

- Brookland (Affordable single-family homes with growth potential)

12. Is there still demand for luxury homes in Washington, D.C.?

Yes! The luxury market remains strong, particularly in Kalorama and Georgetown, where politicians, diplomats, and executives seek premium properties.

13. How is the commercial real estate market doing?

The office market is facing challenges due to remote work and federal workforce downsizing. However, retail and mixed-use developments continue to thrive.

14. How are condos selling in Washington, D.C.?

Condos remain popular among young professionals and investors, though higher HOA fees can be a downside. Newer buildings in Navy Yard and NoMa are seeing steady sales.

15. Are housing prices expected to rise or fall in 2025?

Prices are likely to remain stable or see modest increases as mortgage rates decline and demand picks up again.

16. What’s the rental market like in D.C.?

Rental prices have been rising, with the average rent at $2,500/month. High demand from government workers and young professionals keeps rental properties competitive.

17. Are foreclosures increasing in Washington, D.C.?

Not significantly. While some homeowners are facing higher mortgage costs, government assistance and refinancing options have prevented widespread foreclosures.

18. What are closing costs like in D.C.?

Buyers should expect 2% to 5% of the purchase price in closing costs. Sellers also have costs, including a 1.1%–1.45% transfer tax based on the property price.

19. Are there tax incentives for homebuyers in Washington, D.C.?

Yes! Programs like D.C.’s First-Time Homebuyer Tax Credit offer savings, and some buyers can qualify for down payment assistance programs.

20. How do property taxes in Washington, D.C. compare to nearby areas?

D.C. has relatively low property taxes compared to Maryland and Virginia, averaging 0.55% of a home’s assessed value.

21. Is house flipping still profitable in D.C.?

Yes, but renovation costs and competition are high. Flipping is most successful in up-and-coming areas like Brookland or Anacostia.

22. Is D.C. a good market for Airbnb or short-term rentals?

Yes, but strict regulations apply. Short-term rental owners must register with the city and comply with limits on rental days per year.

23. How long does it take to buy a house in D.C.?

The process can take 30–60 days, depending on financing and inspections. Competitive offers and cash purchases can close faster.

24. Are homes in the suburbs cheaper than in D.C.?

Yes. Nearby suburbs in Maryland (Silver Spring, Bethesda) and Virginia (Arlington, Alexandria) offer larger homes for lower prices.

25. What’s the biggest challenge for homebuyers in D.C. right now?

Affordability. High home prices and interest rates make it tough for first-time buyers to enter the market.

26. How do I know if I’m getting a good deal on a home?

Work with a local real estate agent who understands market trends. Compare recent sales (comps) and neighborhood price trends before making an offer.

27. How can I sell my home quickly in Washington, D.C.?

- Price it competitively

- Stage it professionally

- Market it online and through real estate networks

- Offer incentives (closing cost assistance, quick closing)

28. What is the best season to buy or sell a home in D.C.?

Spring and summer are peak seasons, but buyers can find better deals in fall and winter when demand is lower.

29. Can I negotiate home prices in D.C.?

Yes! In hot markets, sellers have leverage, but in slower markets, buyers can negotiate better deals, closing costs, or seller concessions.

30. Is Washington, D.C. still a good place to buy real estate in 2025?

Absolutely! Strong job growth, government stability, and high rental demand make D.C. a solid real estate investment for both buyers and investors.