Understanding the ins and outs of taxes is crucial for any homeowner in Virginia. Many people often confuse real estate taxes with property taxes. Here at Red Door Metro, a premier real estate agency in Tysons Corner, Virginia, founded by George M Mrad, we believe in educating our clients about these critical distinctions. Let’s dive into what these terms mean, how they’re calculated, and the rules that apply.

Real Estate Taxes

Real estate taxes are specifically levied on land and buildings. These taxes are assessed by local governments, such as cities or counties, and the revenue supports essential public services like schools, infrastructure, and emergency services.

How Are Real Estate Taxes Calculated?

Real estate taxes are based on the assessed value of your property. Here’s the typical calculation process:

- Assessment: The local government assesses your property’s value. This assessment usually occurs annually and includes the value of both the land and any structures on it.

- Tax Rate: Each locality sets its own tax rate, usually expressed per $100 of assessed value.

- Calculation: Multiply the assessed value by the tax rate to determine your tax bill.

Example: If your home is assessed at $300,000 and your locality’s tax rate is $1.10 per $100 of assessed value, your real estate tax would be: Tax=300,000/100×1.10 = $3,300

Property Taxes in Virginia

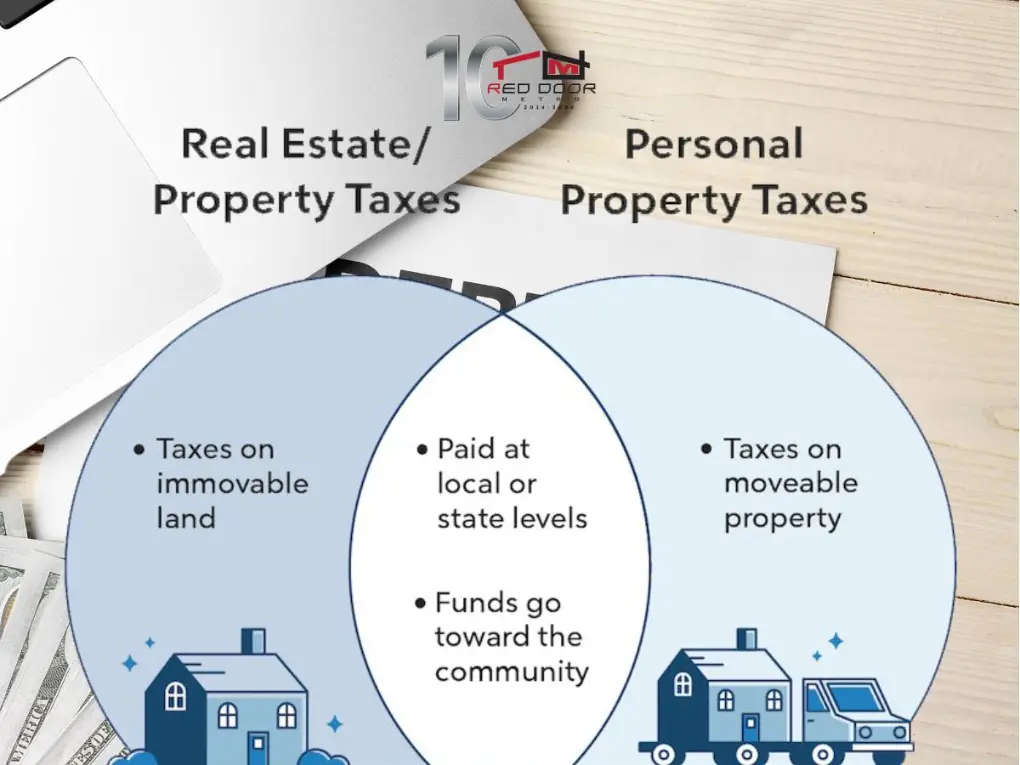

Property taxes is a broader term encompassing both real estate taxes and taxes on personal property like vehicles, boats, and business equipment.

In Virginia, property taxes include:

- Real Property Taxes: These are the same as real estate taxes, applying to land and buildings.

- Personal Property Taxes: These apply to movable assets such as cars, motorcycles, and RVs.

Personal Property Tax Calculation

Personal property taxes are calculated similarly to real estate taxes but apply to items like vehicles. The value is typically based on a pricing guide or fair market value.

Example: If you own a car valued at $20,000 and your locality’s personal property tax rate is $3.50 per $100 of assessed value, your tax would be: Tax=20,000/100×3.50=$700

Key Differences Between Real Estate and Property Taxes

- Scope:

- Real Estate Taxes: Apply solely to real property (land and buildings).

- Property Taxes: Include real estate taxes and personal property taxes (vehicles, boats, etc.).

- Tax Rates:

- These rates vary by locality.

- Real estate and personal property taxes often have different rates, even within the same area.

- Usage:

- Both types of taxes fund local services, but real estate taxes primarily support schools, public safety, and infrastructure.

Important Rules and Deadlines in Virginia

- Assessment Frequency: Properties are typically reassessed annually, though this can vary.

- Tax Due Dates: Real estate taxes are often due semi-annually, while personal property taxes might be due annually or semi-annually.

- Tax Relief Programs: Virginia offers tax relief for elderly and disabled homeowners and veterans.

Real Estate Tax Relief Programs

Virginia provides various tax relief programs, which can significantly reduce the tax burden for eligible homeowners. These programs often cater to senior citizens, disabled individuals, and veterans. For example:

- Senior Citizens: Reduced rates or exemptions for homeowners over a certain age.

- Disabled Homeowners: Tax reductions based on disability status.

- Veterans: Tax exemptions or reductions for veterans, especially those with disabilities.

Conclusion

In Virginia, real estate taxes are a specific type of property tax focused on land and buildings, whereas property taxes can also include personal property like vehicles. Understanding these differences is essential for budgeting and financial planning as a homeowner. At Red Door Metro, we’re committed to helping our clients navigate these complexities. For personalized assistance and expert advice, feel free to reach out to us.

By staying informed, you can ensure you’re prepared for all the financial responsibilities of homeownership. Always check with your local tax assessor’s office for the most current information about rates and deadlines.

For more information, or if you have any questions, don’t hesitate to contact Red Door Metro, your trusted real estate agency in Tysons Corner, Virginia.