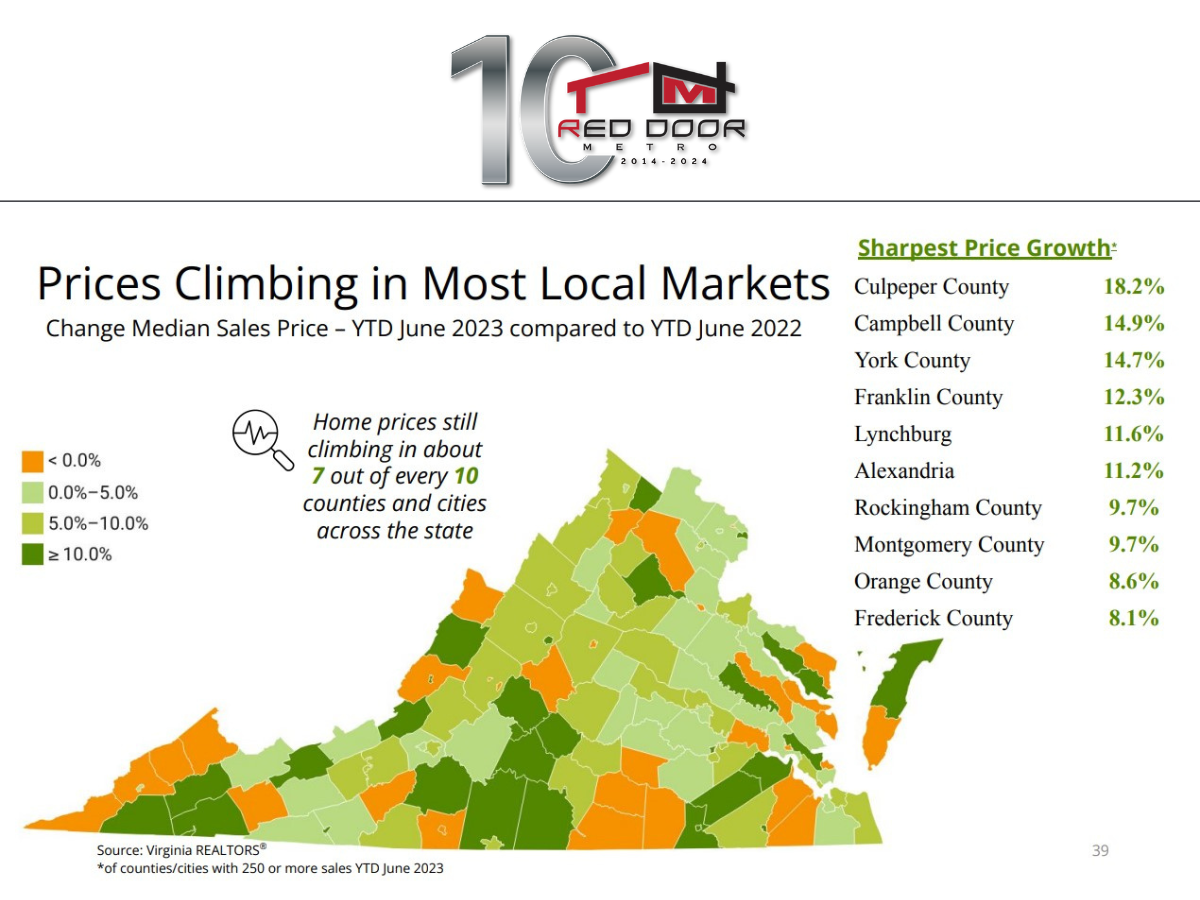

Understanding Virginia’s Real Estate Market

Virginia, with its diverse landscape, strong economy, and historical significance, has long been a popular choice for both residents and investors. Over the past decade, the state’s real estate market has experienced steady growth, driven by various factors.

Factors Influencing Property Value Appreciation

- Proximity to Major Cities: Areas near major cities like Richmond, Norfolk, and Virginia Beach have generally seen higher property value appreciation due to increased demand and job opportunities.

- Economic Growth: Virginia’s robust economy, particularly in sectors such as technology, healthcare, and government, has contributed to rising property values.

- Job Market: Regions with strong job markets and low unemployment rates tend to have higher property demand and prices. For example, Northern Virginia, with its proximity to Washington, D.C., has experienced significant growth due to the strong job market in the federal government and related industries.

- Schools and Education: Proximity to quality schools and universities can significantly impact property values, as families often seek homes in desirable school districts. In areas like Fairfax County and Loudoun County, schools are highly rated, attracting families and driving up property prices.

- Amenities: Access to amenities such as parks, recreational facilities, and shopping centers can increase property desirability and value. For instance, properties near popular tourist destinations like Virginia Beach and Williamsburg often benefit from increased demand and higher prices.

- Infrastructure: Improved infrastructure, including transportation and utilities, can positively impact property values. For example, the expansion of the Virginia Railway Express (VRE) has increased accessibility to major cities, boosting property values in nearby areas.

Regional Variations

- Northern Virginia: This region, particularly around Washington, D.C., has experienced some of the highest property value increases in the state due to its proximity to the nation’s capital and strong job market.

- Central Virginia: Richmond and its surrounding areas have seen steady growth, driven by a diverse economy and a growing population. The revitalization of downtown Richmond and the development of new neighborhoods have contributed to rising property values.

- Tidewater Region: Coastal cities like Norfolk, Virginia Beach, and Hampton have experienced strong property value appreciation, fueled by tourism, military bases, and a growing population. The region’s natural beauty, beaches, and recreational opportunities have also attracted buyers.

- Shenandoah Valley: This region offers a more rural lifestyle and has seen steady property value growth due to its natural beauty and proximity to outdoor recreation opportunities. The Shenandoah National Park and wineries in the area have contributed to increased demand for properties in the region.

Key Trends Over the Past Decade

- Increased Demand: Rising population and job growth have led to increased demand for housing in many parts of Virginia.

- Low Interest Rates: Historically low interest rates have made homeownership more affordable, driving up property prices.

- Investor Activity: Real estate investors have been active in the Virginia market, contributing to rising property values.

Conclusion

While the average property value increase in Virginia over the past decade has been positive, it’s important to note that individual markets can vary significantly. Factors such as location, property type, and market conditions will influence specific property value appreciation.